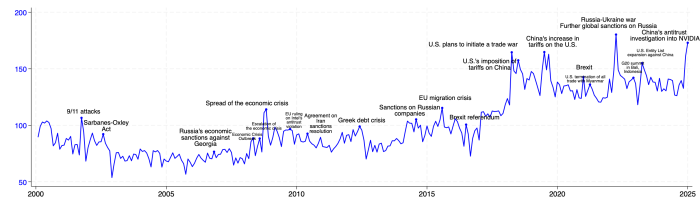

We construct and calculate a Geoeconomic Risk (GER)1 Index based on newspaper coverage of geoeconomic events. The index indicates that events such as the 9/11 attacks, the 2008 financial crisis, the Greek debt crisis, the European migration crisis, the 2018 trade war, and sanctions after the Russia–Ukraine war significantly increase geoeconomic risk. We further decompose the index by country and by component, and compare the GER Index with other major indices including the GPR, EPU, TPU, and UCT. Our analysis also shows that geoeconomic shocks have negative short-term impacts on the U.S. economy but contribute to increased investment, employment, stock market performance, and GDP in the long run. Moreover, we empirically find that the Geoeconomic Risk (GER) has a positive effect on U.S. corporateinvestment, suggesting that it promotes the reshoring of capital and manufacturing back to the United States.

Figure 1: GER Index from 2000 Note: Recent GER index from 2000 through 2024.

(Index is normalized to 100 throughout the 2000-2024 period.)

王道平等,2025:《中国地缘经济风险测度、演化及影响分析》,IMI Working Paper No.2507

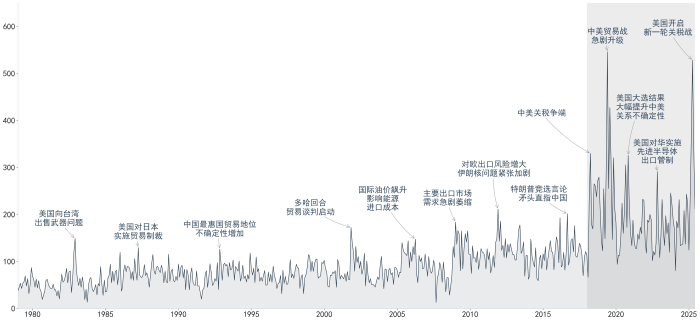

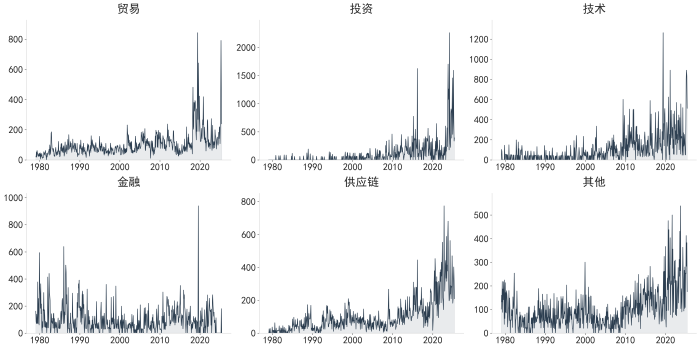

随着全球政治经济格局的深刻调整和国际竞争的日趋激烈,地缘经济风险已成为影响国家经济安全与发展的重要因素。本文利用新闻文本大数据,构建了中国地缘经济风险指数,旨在量化中国官方视角下地缘经济风险程度及其动态演变。研究发现,中国的地缘经济风险在过去四十余年中呈现出显著的阶段性特征,本文构建的地缘经济风险指数聚焦于由国际关系驱动、通过经济手段表现出的对抗与摩擦,能够准确、更具针对性地衡量中国所面临的地缘经济风险。进一步的实证分析表明,地缘经济风险对中国的宏观经济状况、金融市场表现和对外经济活动具有显著的影响。这些发现为理解和预测地缘经济风险冲击下的中国宏观经济和金融市场波动提供了有价值的经验证据,也为相关政策制定者评估风险、制定应对策略提供了重要的参考依据。

Figure 2: 中国地缘经济风险指数演变趋势

Figure 3: 细分领域的地缘经济风险